The problem with this however is that it is tough, if not impossible, for the free economic market to put a true cost on environmental issues. The "cost" is down the road and the "benefit" of destroying the environment is now and that leads to distorted ideas and distorted business decisions. I heard a person say a the Alternative Clean Transportation (ACT) conference this week that our minds would adjust if we thought:

"Rather than thinking we inherited the earth from our parents, we should think like we are borrowing it from our children."When you think about borrowing the earth you think about what state it will be when you leave it regardless of whether there is a cost now. And that leads you to build out a very detailed sustainability practice regardless of the immediate payback. And this leads us to this great post about carbon offsets.

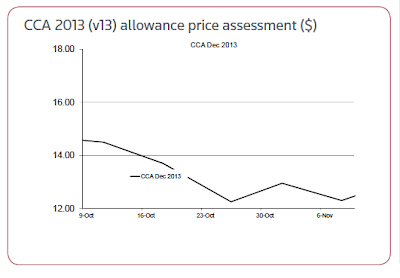

Yes, as Marc Gunther mentions, carbon offsets are so 2007. Essentially the idea was you would either voluntarily or involuntarily (through mandatory carbon offset markets) buy into offset projects to help mitigate the long term damage any action you take may have on the long term of the environment. This led to the EU carbon markets and now the California Carbon Exchange. The problem right now is the price of a ton of carbon is far too low.

Some point to the fraud which naturally was part of these markets as proof they did not work - kind of like saying because people get murdered in Chicago it is proof the laws against murder are not good for society. This is a ridiculous argument. The fact there is fraud says more about the general business community than it does about the markets.

In the end, to build a true sustainability program you have to invest beyond the hear and now from an immediate business case, you have to acknowledge the markets do not properly price issues like carbon emissions, global warming, rise of sea levels etc. etc., and you have to be willing to do something about it. I am not saying you have to bankrupt your company in the defense of the environment but I am saying you have to realize that the market does not price 400ppm of carbon in the atmosphere properly. The carbon which brought us to 400ppm was catastrophic (see where some say 350ppm was the tipping point) and the marginal cost should have been astronomical. But, alas, it was not; it was essentially free. That is a market which is not working properly.